Digital delivery is set, gradually but inexorably, to displace broadcast and cable television as the dominant form of video consumption, according to a new report from Citigroup that offers new details on the factors affecting that spread.

The 31-page in-depth report, by a group of analysts led by Jason Bazinet, breaks down key factors in the global spread of online video, including broadband adoption and speeds, traditional pay-TV penetration rates, and the number of free broadcast channels available.

Before we look at the future, however, some background on the past.

Historically, the barriers to enter to the TV business have been both high and expensive. If you wanted to be in the TV business, you needed scarce spectrum to deliver broadcast signals, or lots of money to lay cable pipes or launch satellites into space. Now, as Bazinet's team points out, all you need is a web server.

According to Citi's analysts, this basic change, coupled with increasing broadband availability and the proliferation of apps, is altering the TV landscape from "the push-based delivery of linear channels over closed TV systems, to the pull-based delivery of specific shows via an app over an open system."

Put more simply, consumers prefer loading up Netflix or Hulu and streaming shows over the web on their terms as opposed to having to be home at a certain time to watch their favorite programs or having to subscribe to a pay-TV service to gain access to video-on-demand content. The report cites as evidence to support its theory the fact that U.S. households owning a TV have declined two straight years, and a decline in cable TV ratings in recent years that has led to a corresponding slowdown in the pace of advertising growth.

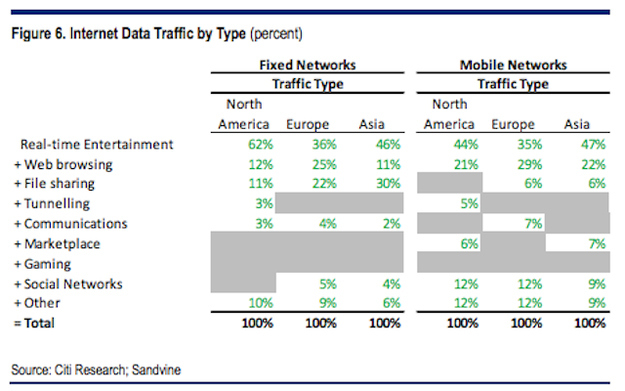

Those data points also dovetail with the chart below, which shows that real-time entertainment, including video consumption, accounts for the overwhelming amount of Internet traffic in North America, Europe, and Asia.

Real-time entertainment dominates web data traffic.

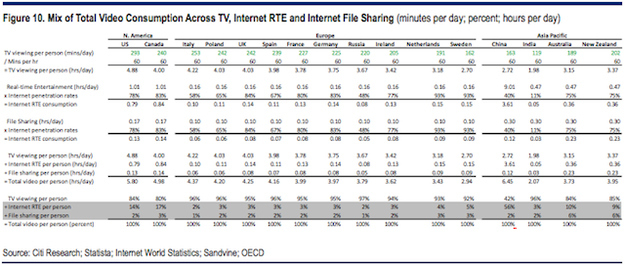

Next, the report breaks down video consumption across platforms by region.

Among the findings are that China, despite having a relatively low 163 total minutes of video viewing per day, is by far the leader in web-based watching, with about 58% of consumption happening digitally. About 10–20% of video consumption in the U.S., Australia, and Canada occurs on the web, while in most European countries that figure is between 3% and 8%.

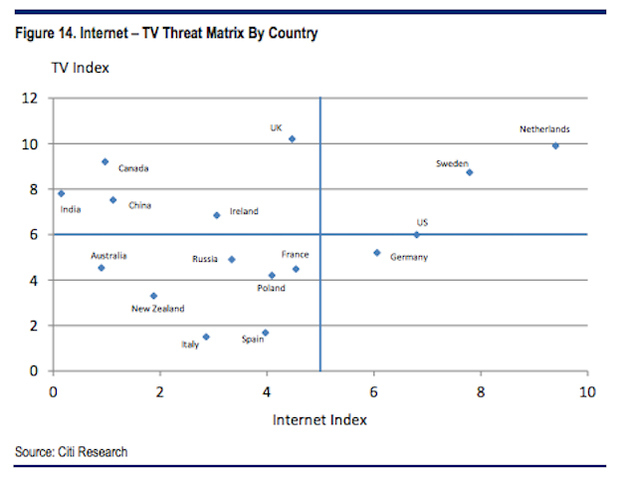

Looking at the internet's ability to deliver video content and the vulnerability of existing pay-TV markets, the report breaks down which countries are most susceptible to web-based video disruption.

Citi's analysts conclude that countries that have higher levels of broadband penetration, quicker delivery speeds, and no data caps are likely to be at greater risk of the Internet disrupting pay-TV. Conversely, they also surmise that countries with higher penetration of pay-TV and large numbers of free broadcast stations increase the risk of cord-cutting. Based on those assumptions, the report concludes that the U.S., Netherlands, and Sweden face the greatest risk of web-based video disrupting their pay-TV ecosystem. Germany is also vulnerable, but to a lesser extent, according to the analysts.

The U.K., Ireland, China, Canada, and India — all of which are have high video consumption rates but low broadband penetration levels — will be at more risk as their internet infrastructure develops.

At low risk for disruption are France, Poland, Russia, Spain, Italy, New Zealand, and Australia, primarily because all those countries feature both low broadband and low pay-TV penetration.

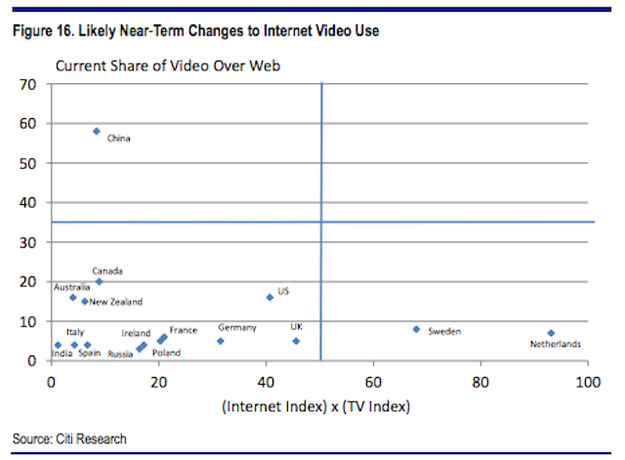

Based on these factors, Citi's analysts expect web-based video consumption to grow the fastest in Sweden and the Netherlands in the near-term.

The report also shows that "Anglosphere countries — including the U.S., Canada, Australia, and New Zealand — are getting a larger portion of their video from the web than other countries, likely due to larger quantities of web-based English language content that appeals to these consumers."