With all of Washington atwitter with the possibility of a government shutdown starting at midnight, economics and investors have another worry: the debt ceiling. Even if Congress manages to agree to keep the lights on for another week or two, they still need to increase the federal government's legal authority to borrow money so that it can pay interest on its debt and appropriations passed by Congress.

According to the Treasury and outside experts, the so-called "X-Date," when the federal government cannot borrow money to pay its bills, starts midnight, Oct. 18. More than two years ago, thanks to a standoff between the Republican-controlled House and President Obama over spending, the government creeped right up to the debt limit but managed to avoid it thanks to a last-minute deal. But that didn't stop the crisis from affecting the real economy.

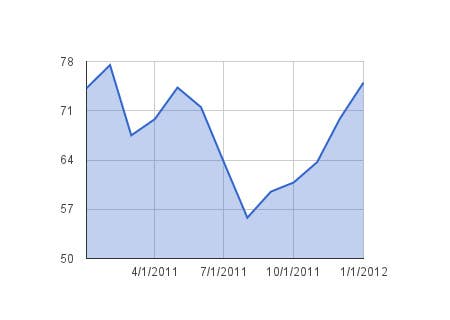

1. Consumer Sentiment

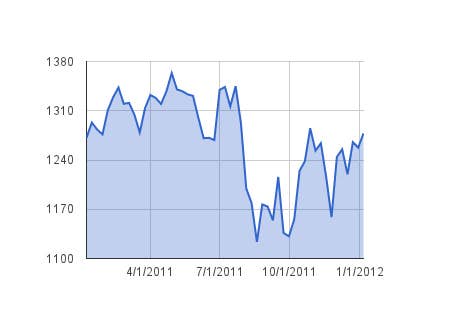

2. The S&P 500

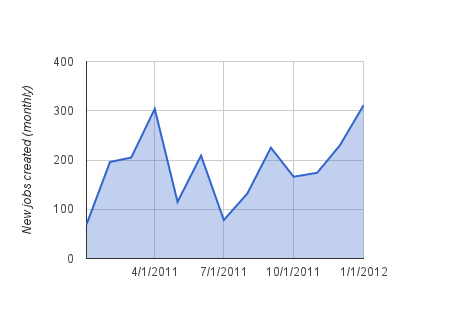

3. Jobs

4. Treasury Bonds